Determining land value for depreciation

Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form. Add the market value.

How To Find The Market Value Of Vacant Land Retipster

Divide the value of the house by the value of the property.

. The basis of a real estate asset is defined as the total amount paid to acquire the property. But in reality a. Property depreciation for real estate related to MACRS.

For example the first-year. Calculate your annual depreciation by dividing the. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life.

The remainder is the buildings basis which is usually fully depreciable over 275 years. For instance a widget-making machine is said to. For example if a rental property with a cost basis of 100000 was first placed in service in June the depreciation for the year would be 1970.

Many first-time home buyers believe the physical characteristics of a house will lead to increased property value. Multiply your result by your cost basis to determine the cost basis of the house which is the amount you depreciate. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear.

Top Things that Determine a Homes Value. How do I determine the land value vs building value of the condominium building. Unfortunately there is no magic bullet in valuing land.

The productive or profitable lifespan of the asset range from 3 to 20 years for private property. 100000 cost basis x 1970 1970. For example Marks property is for 150000.

The IRS wants the buildings value in order to determine depreciation schedule. 15 to 20 years for land progress for real estate 275 years and for business real estate 39 years. As any real estate appraiser can tell you its virtually impossible to reach the point of 100 certainty.

Subtract the land value from your cost basis. Number of years after constructionTotal age of the building 1060 16 The remainder of the useful age is the actual selling price of the construction. What Determines Land Value.

Step 1 Determine the Cost Basis.

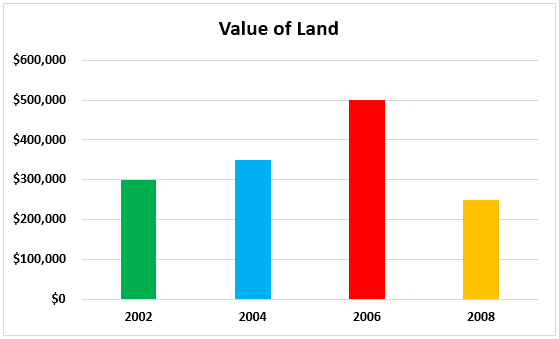

Does Land Depreciate In Value Accounting Effect Examples

How To Find The Market Value Of Vacant Land Retipster

How To Use Rental Property Depreciation To Your Advantage

Calculating The Land And Building Value Of Your Rental Property

A Map Of Every Non Disclosure State In The U S And How Real Estate Investors Can Deal With Them Real Estate Investor Real Estate Tips Real Estate Advice

Depreciation Of Building Definition Examples How To Calculate

Does Land Depreciate In Value Accounting Effect Examples

4 Steps On How To Calculate Land Value

Real Estate Depreciation

5 Methods To Calculate Land And Property Value In India

How To Find The Market Value Of Vacant Land Retipster

Depreciation Of Building Definition Examples How To Calculate

Kbkg Tax Insight A Taxpayer S Property Purchase Land Versus Building Allocation

How To Calculate Land Value For Tax Purposes

Depreciation For Your Rental Property Calculating The Improvement Ratio

How To Calculate Land Value For Taxes And Depreciation Accounting Marketing Calendar Template Financial Wellness

Revaluation Of Fixed Assets Bookkeeping Business Accounting Education Fixed Asset